About Nethermind Research

Nethermind DeFi Research provides technical research and advisory services to venture capital firms, hedge funds, and protocol teams. Our focus areas include protocol due diligence, quantitative modeling, tokenomics design, and risk analysis. All outputs are grounded in cryptoeconomic rigor, delivering actionable insights and technically sound recommendations.

Nethermind Research received a grant from dYdX Grants to review dYdX Chain incentives, dYdX fees, the distribution of net revenue and tokenomics, among other things.

Introduction/Abstract

On August 26, 2025, dYdX Labs published a public roadmap declaring that “dYdX is entering a new chapter of growth, innovation, and ruthless execution.” As competitive pressure intensifies, our research is directly aligned with pillars 2 and 3 of dYdX’s strategy: delivering a world-class consumer experience and maximizing token utility.

Before addressing tokenomics and incentives more broadly, our initial research phase is targeting the most immediate opportunities—on-chain parameters that are straightforward to adjust. As such, we are advancing a proposal to simplify the fee tiers. This proposal is an extension of the research on the trading rewards and simplification of incentives.

Simplifying the fee tiers

Summary

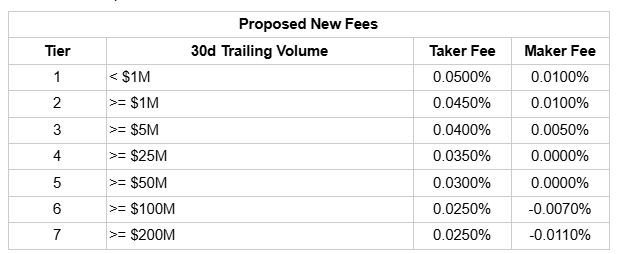

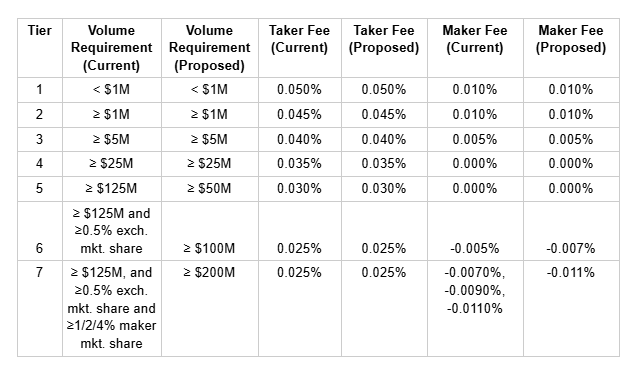

This proposal seeks to simplify the fee tiers by reducing them from 9 to 7 distinct tiers and removing the market and exchange share conditions. The goal is to lower entry barriers for market makers and encourage more liquidity on dYdX.

Abstract

The current fee tiers likely create entry barriers for new market makers, as the highest maker rebates require meeting specific exchange and maker share thresholds. This could prevent more liquidity from being deployed on dYdX, reducing its attractiveness for traders in general.

We are proposing to restructure the existing fee tiers by reducing the number of tiers (from 9 to 7) and removing the conditions linked to market share and exchange share on dYdX. This change aims to encourage new makers to onboard, and to incentivize both new and existing makers to provide additional liquidity on the platform, thereby increasing volumes and fees for the protocol.

Motivation/Rationale

The new simplified 7-tier fee structure eliminates the extra complexity of the exchange share and market share requirements while ensuring that dYdX remains competitive with leading exchanges like Binance, OKX, Bybit and Hyperliquid. Key changes include introducing new volume thresholds at $50M, $100M and $200M with more aggressive market rebates.

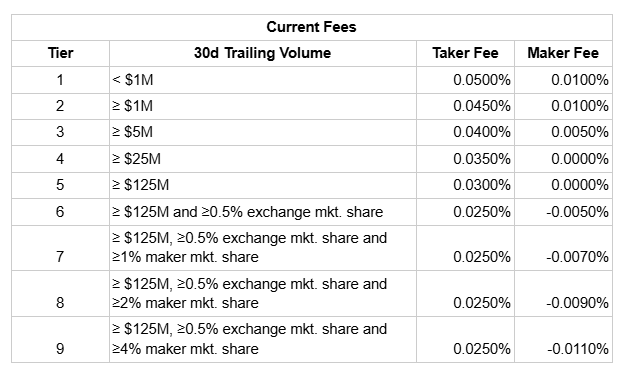

Below is a comparison between the current and proposed fees:

Key benefits of the new fee tiers:

1. Reduced complexity: No need to track market and exchange share metrics, reducing operational complexity while maintaining economic incentives.

2. Clearer Progression: Linear volume advancement gives predictable cost structure for traders and market makers.

3. Competitive Necessity: Combines market-leading rates with simplified access requirements.

4. Market Leadership: The new market fees at high volumes ($100M - $200M) positions dYdX as a market leader for institutional trading.

Competitors Analysis

Taker Fee Comparison

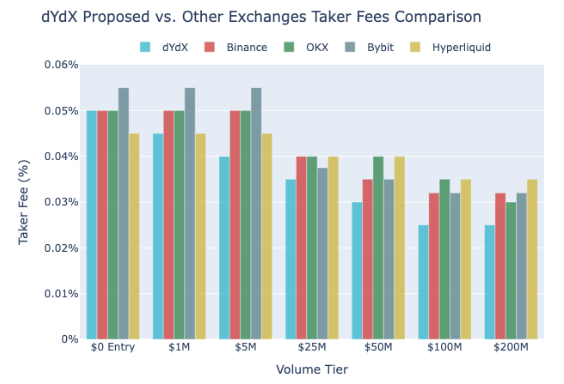

The taker fee structure has been carefully evaluated against competing exchanges and with the addition of a new $50M volume tier, remains highly competitive across all tiers.

-

Low to Mid Volume ($0-$25M): dYdX’s existing taker fees are already competitive, offering better or equal rates compared to most competitors.

-

Introduction of New Volume Tiers: The new tiers at $50M and above continue this competitiveness. The charge of 0.030% taker fees at the $50M tier provides an advantage over Binance’s 0.035% and favorable positioning against Bybit and Hyperliquid.

-

High Volume Tiers ($100M and $200M): The new $100M and $200M tiers, each with 0.025% taker fees, further strengthen dYdX’s competitive position by offering lower rates than Binance’s 0.032%, Hyperliquid’s 0.035%, and Bybit’s 0.032% at comparable volumes.

Note: For comparison purposes we have excluded any temporary promotional offers or staking requirements. Hyperliquid’s fee structure has also been normalized to a 30-day volume basis for consistency.

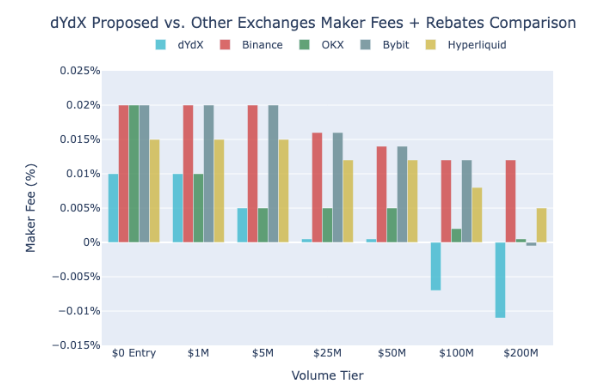

Maker Fee Comparison

The maker’s proposed new fee restructuring eliminates complex rebates and maintains existing competitive fees.

-

Simplified Early Tiers: Beginning at $25M volume, maker fees drop to 0% providing competitive advantage over competitors.

-

Enhanced Rebate Structure: The new $100M tier introduces -0.7% maker fees positioning dYdX ahead of other exchanges that require additional qualification, , such as market share and maker market share–based thresholds, to unlock equivalent rates.

-

Pure Volume-Based Approach: By removing exchange and maker market share requirements, it simplifies the fee structure while maintaining the same economic benefits.

Note: Given the varying liquidity requirements for rebates across exchanges, we have selected the highest rebate available at each volume tier for every exchange, excluding any temporary promotional offers or staking requirements. Hyperliquid’s fee structure has been normalized to reflect a 30-day volume. It should also noted that some exchanges requires significant more capital deployment to access the rebates,

Maker Rebates Comparison

It’s important to highlight that the proposed maker fees result in an easier path to access more advantageous fee tiers compared to competitors. A key differentiator of this proposal, and restated here, is that dYdX will potentially introduce maker rebates without volume thresholds, unlike most competitors that typically require significant volume benchmarks to qualify for rebates. This makes dYdX easier to get more advantageous fee tiers, lowering the entry barrier for accessing better fees.

When comparing dYdX’s proposed fee tiers with the aggregate of maker fees and rebates from other exchanges, dYdX consistently maintains competitive maker fees across all volume levels. The platform becomes especially compelling for higher volume participants by offering substantial rebates, which serve as a powerful incentive for liquidity providers. This tiered approach not only rewards active trading and volume growth but also contributes to deeper and healthier liquidity across the protocol.

Projected Impact on dYdX Fee Revenue

August volume data shows this fee tier adjustment will affect ~30 accounts, costing the dYdX exchange approximately $80k a month, assuming that volume remains constant. The enhanced tier benefits are expected to attract new participants and drive higher trading volumes from both existing and new traders and market makers, ultimately generating increased fee revenue for dYdX.

Future Considerations

The dYdX community is strongly encouraged to consider future opportunities for fee promotions, fee holidays, and discounted trading fees through DYDX staking. These strategies, which are planned for phase two of the roadmap, could further enhance dYdX’s competitiveness and incentivize deeper liquidity participation moving forward.

Project Milestone and Next Steps

This fee tier analysis and the ending protocol-level trading rewards proposal concludes Phase I of the grant-support research. In the coming weeks, we will work on Phase II, focused on enhancing the dYdX Chain’s performance, resilience, and the utility of the DYDX token.

Specification

To change the fee tiers, MsgUpdatePerpetualFeeParams is used to update the Fee Tiers 5-9 from:

*{*

*"name": "5",*

*"absolute_volume_requirement": "125000000000000",*

*"total_volume_share_requirement_ppm": 0,*

*"maker_volume_share_requirement_ppm": 0,*

*"maker_fee_ppm": 0,*

*"taker_fee_ppm": 300*

*},*

*{*

*"name": "6",*

*"absolute_volume_requirement": "125000000000000",*

*"total_volume_share_requirement_ppm": 5000,*

*"maker_volume_share_requirement_ppm": 0,*

*"maker_fee_ppm": -50,*

*"taker_fee_ppm": 250*

*},*

*{*

*"name": "7",*

*"absolute_volume_requirement": "125000000000000",*

*"total_volume_share_requirement_ppm": 5000,*

*"maker_volume_share_requirement_ppm": 10000,*

*"maker_fee_ppm": -70,*

*"taker_fee_ppm": 250*

*},*

*{*

*"name": "8",*

*"absolute_volume_requirement": "125000000000000",*

*"total_volume_share_requirement_ppm": 5000,*

*"maker_volume_share_requirement_ppm": 20000,*

*"maker_fee_ppm": -90,*

*"taker_fee_ppm": 250*

*},*

*{*

*"name": "9",*

*"absolute_volume_requirement": "125000000000000",*

*"total_volume_share_requirement_ppm": 5000,*

*"maker_volume_share_requirement_ppm": 40000,*

*"maker_fee_ppm": -110,*

*"taker_fee_ppm": 250*

*}*

To as follows:

*{*

*"name": "5",*

*"absolute_volume_requirement": "50000000000000",*

*"total_volume_share_requirement_ppm": 0,*

*"maker_volume_share_requirement_ppm": 0,*

*"maker_fee_ppm": 0,*

*"taker_fee_ppm": 300*

*},*

*{*

*"name": "6",*

*"absolute_volume_requirement": "100000000000000",*

*"total_volume_share_requirement_ppm": 0,*

*"maker_volume_share_requirement_ppm": 0,*

*"maker_fee_ppm": -70,*

*"taker_fee_ppm": 250*

*},*

*{*

*"name": "7",*

*"absolute_volume_requirement": "200000000000000",*

*"total_volume_share_requirement_ppm": 0,*

*"maker_volume_share_requirement_ppm": 0,*

*"maker_fee_ppm": -110,*

*"taker_fee_ppm": 250*

*}*

Next Steps

We invite the dYdX community to provide feedback on this proposal. If there is no significant objection, we plan to submit the on-chain proposal on September 18, 2025

Disclaimer

It is important to note that this report only contains research data points and theoretical proposals for their independent evaluation by readers. All of the proposals in this report would require an active governance decision by the dYdX community to be implemented(and, in certain cases, and in addition, the collaboration of certain ecosystem participants, such as the treasury subDAO, for example). Nethermind has no control over any decision to implement any of the proposals mentioned in this report or the way that they may be implemented.

Nothing in this report should be considered as financial, legal, tax or any other form of advice, nor as an instruction or invitation to act by anyone. This report has been prepared and is being published for informational and educational purposes only.

Kindly note that this proposal is not intended to create a contractual relationship between Nethermind and the receiving party. Any engagement of services shall be subject to a separate agreement that outlines the terms and conditions of the engagement. Please note that the contents of this proposal may be subject to intellectual property rights owned by Nethermind.