kpk is pleased to present the dYdX Treasury SubDAO’s 1H 2025 Community Update, highlighting key developments and initiatives for the last 6 months.

To begin, we present a summary tracing the timeline from the dYdX Treasury SubDAO Request for Proposal (RFP) to the current state:

Financial Update

Since its inception, the Treasury SubDAO has achieved:

- Accumulated gross revenue of USDC 2.49 M, comprising of:

- Staking Rewards: USDC 1.056 M

- Revenue Share from Buyback Program: USDC 1.437 M

According to the June 2025 monthly report, the following key metrics were observed:

-

$44.6M of Assets Under Management

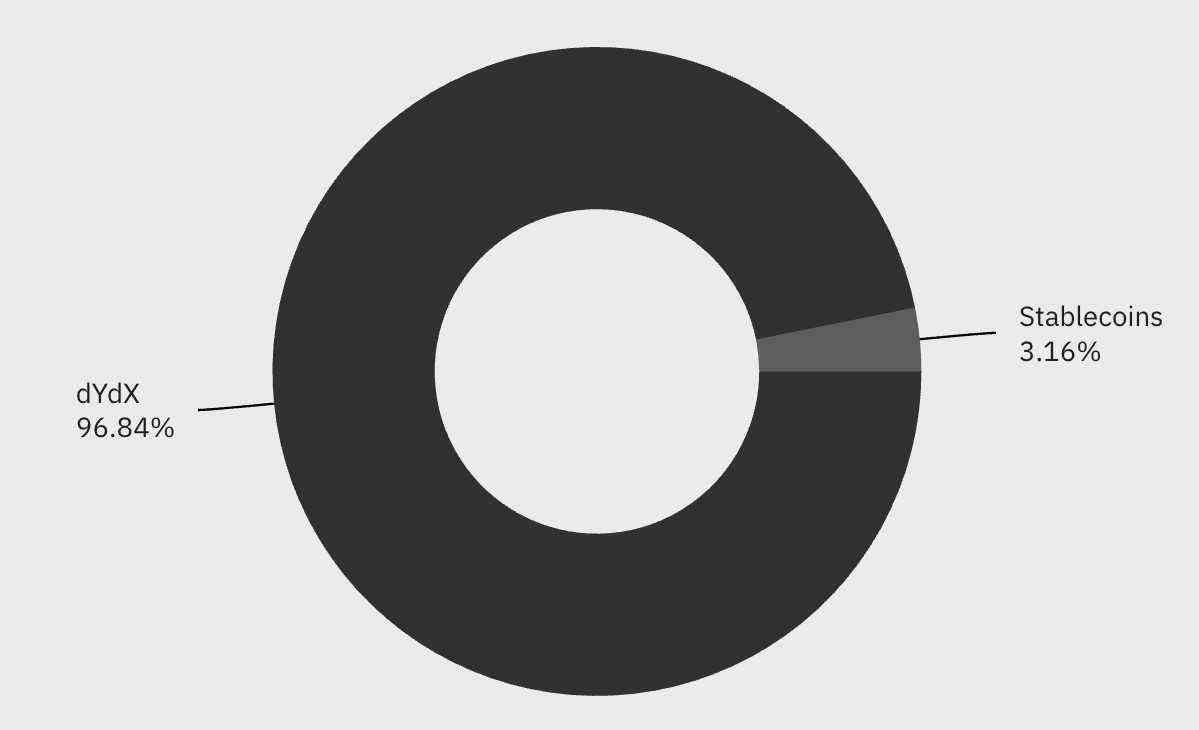

- Asset Allocation (Figure 1): 96.84% in DYDX, 3.16% in stablecoins.

- Though we continue to diversify from DYDX into stablecoins, it should be noted that the DAO’s stablecoin assets are being used to fund the operations of the Ops SubDAO, and so the allocation to stablecoins will vary over time.

-

Marked-to-market (“MTM”): Treasury SubDAO assets suffered from a decrease in market value of $2.44M in MTM, due to a decrease in the DYDX token price from $0.55 to $0.52 in the month of June.

-

Megavault Results: since the deployment of $300k USDC to Megavault on February 13th, the Megavault has generated a total of $14.6k, equating to a 12.57% annualised return on investment.

Figure 1: Token Allocation %

Lookback on the Mandate

Staking Program

The dYdX Treasury SubDAO has undergone several changes in the 1H 2025, including:

-

Expansion of the Program through the Stride Recall: 21.63m DYDX was added to the Program. The recall also means the cessation of the 7.5% fee charged by Stride on all staking rewards, which amounted to 132.61k DYDX in the 10 months between launch and the publication of the Recall proposal.

-

Staking on behalf of the Operations SubDAO: the Treasury SubDAO is staking 14m DYDX tokens on behalf of the Operations SubDAO, thus helping the wider DAO to leverage on the dYdX Treasury SubDAO structure to enhance capital efficiency and secure the network

-

Conducting two periodic reviews of the Staking Program, in line with previously established delegation principles and validator scoring criteria. The periodic reviews were necessitated by recent shifts within the dYdX ecosystem and changes to the DYDX token balances managed by the Treasury SubDAO, and have generally contributed to improved validator performance and, by extension, the overall performance of the dYdX protocol.

-

Initial delegation: November 18, 2024

-

First periodic review: February 4, 2025

-

Second periodic review: April 22, 2025

Buyback Program

The Treasury SubDAO Foundation expanded its mandate to include a Buyback Program in March 2025. The Buyback Program started in full swing on April 23rd, 2025, continuously allocating 25% of Protocol Revenue towards the purchase of DYDX tokens.

The Buyback Program is comprised of 2 types of transactions:

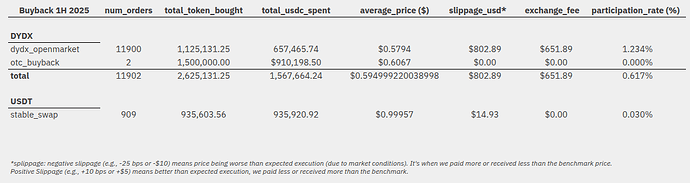

- Open market buyback via Binance: 1.125M DYDX tokens were bought back at an average price of $0.5794.

- OTC transactions: 1.5M DYDX tokens were bought back at an average price of $0.6067 from the dYdX Operations SubDAO. The OTC transactions help to coordinate DAO-wide finances and transactions effectively, reducing transaction costs.

For open-market operations, the Treasury SubDAO Foundation is executing via execution algorithms that minimise market impact (i.e. trade sizes are dynamically adjusted with market volume and participation rate) while maintaining execution efficiency (i.e. optimize for cost efficiency via passive execution).

All buyback-related activity remains fully transparent and can be monitored through the community-built Buyback Dashboard.

A detailed breakdown of YTD execution performance and key insights is provided below:

Looking Forward

The Treasury SubDAO Foundation hopes to continue finetuning its execution of the Staking Program and the Buyback Program.

For the Staking Program, we are committed to maintaining our quarterly review of delegation and updating our Delegation Methodology in line with protocol-level updates (e.g. reduction in the active validator set from 60 to 50) and protocol priorities (e.g. optimising for validator location for reduced latency). While the Treasury SubDAO’s delegation principles remain unchanged, the evaluation criteria weightings might change to support a more-balanced staking distribution and improve validator sustainability.

For the Buyback Program, we are dedicated to fine-tuning our execution algorithm to support the Program. While the price of DYDX oscillated with global markets throughout H1, creating opportune moments for repurchases, alternative scenarios like prolonged bullish or bearish sentiments have yet to be tested in production. As we continue to gain experience with DYDX’s market dynamics, further adjustments to our key metrics and criteria for repurchases will undoubtedly emerge, producing incremental gains in the value the program returns to the DAO.

Given that the Staking Program and the Buyback Program have well-defined processes in place and operate efficiently, it is apt to expand the Treasury SubDAO’s scope further.

The Treasury SubDAO will be exploring the following topics in the next 6 months:

- Yield generation strategies for both DYDX tokens and USDC stablecoins

- Exploration of products designed to bring DYDX exposure to a broader set of users and venues, including capturing some of the growing interest from institutional investors and distributing via offchain venues

We appreciate the trust the dYdX Community has placed in kpk in management of the Treasury SubDAO Foundation, and are committed to ongoing engagement with the community and contributing our knowledge.