kpk is pleased to share the dYdX Treasury SubDAO’s May Community Update, providing an overview of key activities and developments over the past month. This update is complemented by kpk’s May Treasury Report, offering a deeper look into treasury performance and strategy.

DYDX Buyback Program – May Update

The buyback program started on April 23rd, and May marked the program’s first full month of execution.

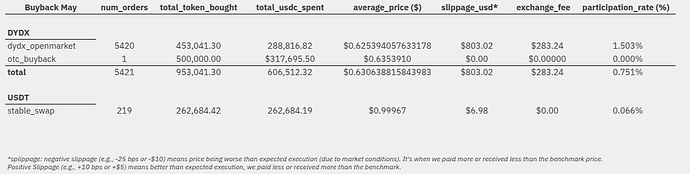

During May Buyback (from May 1st to May 31st), the program successfully allocated 606,512.32 USDC, purchasing 953,041.30 DYDX tokens at an average price of $0.6306388 per token.

453,041.30 DYDX tokens were conducted on a centralised exchange, with tokens periodically withdrawn to the Treasury SubDAO Buyback Account.

The dYdX Treasury SubDAO also completed its first OTC transaction under the Buyback Program. On May 9th, 2025, the SubDAO acquired 500,000 DYDX from dYdX Operations Services Ltd at a price of $0.6353910 per token, for a total of $317,695.50 USDC (see May Buyback table below). The trade was executed directly on the dYdX Chain with full on-chain transparency. The OTC transactions allow for DAO-wide coordination of capital and minimisation of transaction costs and market impact.

Transaction records:

- DYDX received by the Treasury SubDAO (test and final transactions)

- USDC sent to dYdX Operations Services Ltd (view on Mintscan)

Buyback activities for direct CEX purchases and the OTC are fully transparent and can be tracked on a community-built Buyback Dashboard.

Below is a detailed breakdown of May Buyback execution performance and insights:

Staking Program Updates

The Treasury SubDAO made tactical delegation adjustments in May, in response to 2 major developments:

-

Increased DYDX balance (+340,096 from Open Market Buyback, +500,000 DYDX from OTC Buyback), as a result of the Buyback Program,

-

Validation Cloud (previous delegation of 1,943,566.09 DYDX from the Treasury SubDAO) departure from the validator set.

The temporary delegation has been made to validators offering public services. The Treasury SubDAO will conduct its regular re-delegation next month, in line with its pre-established Delegation Criteria (link).

Delegations adjustments are summarised in the tables below:

| Validator | Delegation |

|---|---|

| AutoStake |

+1,311,879.45 |

| Validation Cloud | -1,943,566.09 |

| Polkachu.com | +971,783.05 |

As of May 31, the Treasury SubDAO reached a total value of $46.8M in assets comprising:

- 81.73M DYDX tokens (95.91%) and 1.91M USDC tokens (4.09%).

- Staking Results: 138.5k USDC generated by the Staking Program.

- Marked-to-market (“MTM”): Treasury SubDAO assets suffered from a decrease in market value of $7.48M in MTM, due to a decrease in the DYDX token price from $0.64 to $0.55 for the month of May.

- Megavault Results: since the deployment of $300k USDC to Megavault on February 13th, the Megavault performance has been generating $10.7k, totalling a 11.32% return on investment annualised.

Token Allocation %

Next Steps for June

- dYdX Treasury SubDAO Staking Program: Quarterly delegation rebalancing to adjust DYDX token delegated from the Treasury SubDAO Buyback Account to validators meeting its criteria

- Buyback Program: Continue DYDX buybacks via both CEX and OTC channels