About Nethermind Research

Nethermind DeFi Research provides technical research and advisory services to venture capital firms, hedge funds, and protocol teams. Our focus areas include protocol due diligence, quantitative modeling, tokenomics design, and risk analysis. All outputs are grounded in cryptoeconomic rigor, delivering actionable insights and technically sound recommendations.

Nethermind Research received a grant from dYdX Grants to review dYdX Chain incentives, dYdX fees, the distribution of net revenue and tokenomics, among other things.

Background

In March 2025, dYdX DAO updated its net revenue distribution as follows:

- 40% to stakers,

- 25% to buybacks,

- 25% to MegaVault,

- 10% to Treasury subDAO.

This research aims to evaluate potential adjustments to the current revenue share distribution in light of the MegaVault’s performance, ongoing buyback activities, staking dynamics, and the overall progress of the project. Recently, community members have proposed buyback allocations ranging from 50% to 100% of protocol revenue. This study seeks to provide a data-driven analysis to support and further the ongoing discussion around these proposals, ensuring that any decisions regarding revenue distribution are grounded in sound analysis and aligned with the project’s long-term sustainability and growth objectives.

The research reviews the current allocation by focusing on the following aspects:

- Is the MegaVault delivering enough value for the protocol?

- Should staker allocations be adjusted?

- Can buybacks meaningfully offset inflation and strengthen token sentiment?

Key Takeaways/ Recommendations

- Reduce MegaVault rewards and product revamp from 25% to 0 - 5%. MegaVault has failed to attract users despite current incentive levels. TVL collapsed from $32M in September to $9M, a 72% decline, indicating poor product-market fit. Compared to other incentive programs like Surge, MegaVault is 3x more expensive to bootstrap volume and liquidity. MegaVault rewards could be reduced and/or combined with product improvements such as quoting in fewer markets, maximizing the revenue impact for the protocol and improving the product performance.

- Increase buybacks up to 75%. DYDX token price has fallen significantly over the past months. At present prices, the protocol could repurchase up to 5% of total supply annually. Historical analysis of DeFi protocols buyback announcements shows market-positive reception, with tokens outperforming 13.9% on average post-announcement. Tripling buyback allocation from 25% to 75% would strengthen tokenomics while signaling confidence to the market.

- Reducing stakers allocation from 40% to 15% - 20%. Despite declining yields over the past year, stakers exhibit strong retention—demonstrating low APR sensitivity. This “stickiness” indicates current rewards are sufficient to maintain network security and decentralization.

- Reduce Treasury subDAO allocation from 10% to 5%. As dYdX prices remain depressed, buybacks should be prioritized over Treasury.

MegaVault

We assess whether MegaVault’s 25% revenue allocation delivers enough benefits to justify the cost.

We assess MegaVault performance across three dimensions:

- incremental trading volume generated,

- net protocol fee contribution, and

- strategy returns excluding the incentives distributed.

We then compare these benefits against the actual incentive costs and benchmark alternative incentive structures such as Surge for cost-efficiency

Key Takeaways

- On average, MegaVault costs in incentives 3.24x-3.76x more than front-end Surge rewards to generate equivalent volume and fees. The protocol pays 14x more in incentives than it receives in net fees generated.

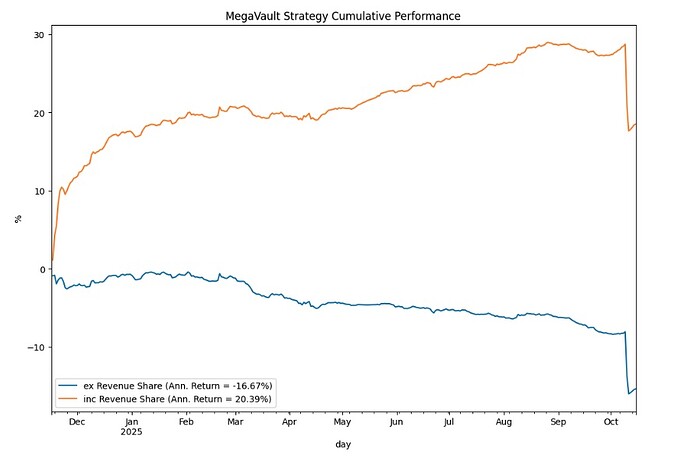

- Excluding incentives, MegaVault has delivered since inception -16.7% annualized returns to investors. The strategy has underperformed consistently since inception, with performance declining sharply from March 2025 onward and deteriorating further following October’s market downturn. Without massive incentive support, the product is fundamentally uncompetitive as a liquidity strategy.

Volume Generated

We look historically at how much volume is generated per of TVL in the Megavault. Excluding some brief spikes at the launch of the Megavault and in March 2025, the annualized volume/ TVL in the vault has remained under $200 p.a.

Trading volumes reflect broader DEX market conditions, which have grown significantly year-over-year. To isolate MegaVault’s performance from market fluctuations, we normalize volumes to $15 billion annually—the average DEX volume over the past three months. This provides a more stable baseline for expected performance.

Since May 2025, the annualized average volume generated by the vault has been around 122 per of TVL.

Fees Generated

The MegaVault provides liquidity that facilitates taker trades on the protocol, generating fees both from its own taker trades and from taker trades it supports by supplying liquidity to other users. Since the vault automatically obtains the best positive fee tier, attention can be focused on taker fees generated by other users’ liquidity. For a simplified, optimistic revenue estimate, we assume all vault trades are maker trades (which generate taker fees for the protocol). In September 2025, the average taker fee was 2.9 bps, with the protocol retaining 1.45 bps after redistributing 50% through the Surge Program. Given an average annual trading volume of $122, each $1 in MegaVault capital generates about 1.77 cents in trading fees for the protocol annually, which is relatively low compared to the capital deployed.

Cost to the Protocol

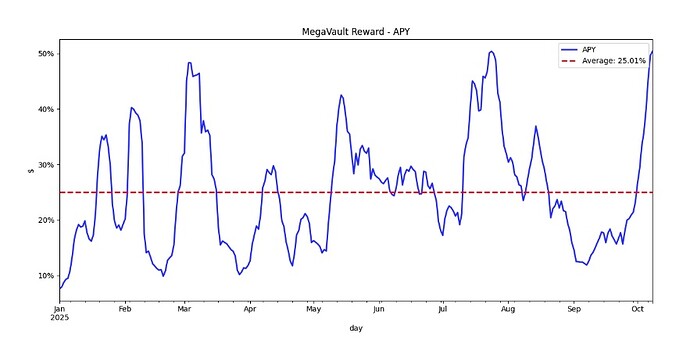

The chart below shows annual Megavault rewards (MegaVault Reward APY) funded solely by dYdX’s 25% revenue share allocation (excluding other fees).

For each $1 of Megavault TVL, dYdX distributes on average $0.25 annually from the revenue share to attract $122 in annual trading volume—yet captures only $0.0177 in annual protocol fees. This means the incentive cost is about 14 times higher than the vault’s benefits to dYdX, making it a low-return initiative. We note that recently, the amount distributed to Megavault users has risen significantly, reaching $0.50 annually per $1 of TVL deposited.

By comparison, the front-end rewards program in September cost $1M, generated $1.58B in volume, and earned $535K in fees, or $267K net after Surge rewards.

Thus, the MegaVault is roughly 3.5 times more expensive than front-end rewards for generating equivalent trading activity.

We also note that introducing a fee holiday on selected markets could be a more cost‑effective way to boost trading volumes, since both current options distribute more rewards than the fees generated.

MegaVault Competitiveness

In this section, we assess the MegaVault’s performance as a product, excluding revenue share. Without incentives, the vault’s annualized return stands at –16.7%. Performance remained stable until March, then declined steadily, with a sharp drop in October following the altcoin flash crash.

To attract liquidity, the protocol must offer substantial incentives—around 35% per year since inception—which is significantly higher than those distributed to standard liquidity pools.

Recommendation

The performance of MegaVault as a market making product has been particularly disappointing since inception and has remained attractive at the cost of large revenue share redistributions. So far Megavault has failed to generate significant value for the protocol in terms of extra volume versus its cost.

We believe that this can be better achieved by other rewards initiatives such as fee holidays, Surge rewards and rewards tailored to front end traders. As a result, we recommend reducing the revenue share. The product needs significant revamping in terms of capital efficiency and performance before allocating significant rewards to the scheme.

Buybacks

Key Takeaways

- dYdX currently allocates 25% of its revenue share to buybacks. At current prices, this accounts for between 1.3% and 1.7% of diluted supply annually.

- Increasing buybacks following a reduction in MegaVault incentives would create more buying pressure and send a positive signal to traders.

- Whilst dYdX price levels remain depressed, we recommend prioritizing buybacks over staking and Treasury DAO allocations. A 75% allocation could buyback up to 5% of total diluted supply annually.

- Based on past announcements from other DeFi protocols, we estimate that this could lead to an average 13.9% price outperformance versus ETH.

Impact on Diluted Supply

Buybacks effectively reduce token inflation and are well-regarded by traders and fundamental investors. The DYDX token, currently depressed after losing 72% over the past year (as of October 21, 2025), makes buybacks especially impactful.

Assuming a $20M annual protocol revenue and various revenue share allocation to buybacks, we analyzed the annual percentage of diluted supply that could be repurchased based on the dYdX token price.

With the token priced between $0.30 and $0.40, current annual buybacks range from 1.25% to 1.67% of diluted supply and they could be increased between 3.75% and 5% should the revenue share allocation increase to 75%.

Impact on Sentiment

Buybacks also boost investor sentiment. To quantify this, we analyzed major 2025 buyback announcements and their impact on token price—excluding ongoing programs like Hyperliquid’s buyback since TGE. On average, the token outperformed ETH by 13.9% in the two days following buyback announcements.

Stakers Allocation

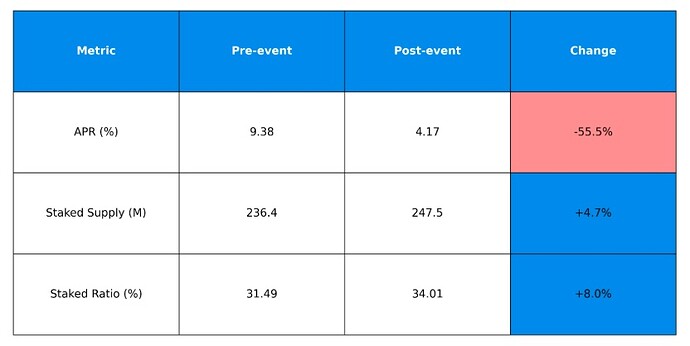

Staking secures the dYdX chain and encourages token holder loyalty, supporting long-term token price appreciation.This section measures staker sensitivity to APR changes analysing the effect of the November 14, 2024 governance vote (proposal 182). The vote reduced staker revenue allocation from 100% to 40%, creating a significant yield decline. We analyze this policy change to determine whether increasing staking rewards would generate substantial buying pressure from stakers seeking to maximize returns.

Key Takeaways

- Despite cutting staking yield from 9.38% to 4.17% by reducing staker revenue allocation from 100% to 40%, staking participation rose from 31.49% to 34.01% of total supply in two months.

- Only 17.9% unstaked, showing strong commitment and confidence among stakers despite lower rewards.

- As a result, a reduction of the revenue share to 15-20% is recommended to prioritize buybacks.

Impact of the Revenue Share Reduction

Historically, DYDX staking has remained relatively stable with no clear relationship to APR fluctuations.

In November 2024, the protocol reduced staker revenue allocation from 100% to 40%, cutting staking yield from 9.38% to 4.17%. Despite the yield reduction, staking participation increased to 34.01% of total supply (247.5M tokens) within two months—up from 31.49% (236.4M tokens).

Only 17.9% of stakers unstaked within two months, demonstrating strong commitment to maintaining their positions

Recommendations

We recommend prioritizing buybacks in light of the depressed DYDX price and the opportunity to create sustained buying pressure and long-term token value. At current levels, the protocol could repurchase up to 5% of total diluted supply annually, ranking dYdX among the top protocols in terms of buybacks. This strategic shift would be funded by reallocating revenue away from the currently underperforming MegaVault—which saw a 72% decline in TVL—and reducing allocations to stakers and Treasury. Increasing buybacks from 25% to 75% of protocol fees is expected to strengthen market confidence and reinforce tokenholder alignment and boost price while supporting the ecosystem’s long-term growth.

Report

For more details, please refer to our research report

Next Steps

We are looking for feedback from the community. We are aiming to submit a formal governance proposal with final details in the upcoming days.

Disclaimer

It is important to note that this report only contains research data points and theoretical proposals for their independent evaluation by readers. All of the proposals in this report would require an active governance decision by the dYdX community to be implemented(and, in certain cases, and in addition, the collaboration of certain ecosystem participants, such as the treasury subDAO, for example). Nethermind has no control over any decision to implement any of the proposals mentioned in this report or the way that they may be implemented.

Nothing in this report should be considered as financial, legal, tax or any other form of advice, nor as an instruction or invitation to act by anyone. This report has been prepared and is being published for informational and educational purposes only.

Kindly note that this proposal is not intended to create a contractual relationship between Nethermind and the receiving party. Any engagement of services shall be subject to a separate agreement that outlines the terms and conditions of the engagement. Please note that the contents of this proposal may be subject to intellectual property rights owned by Nethermind.