We shouldn’t plan the long term strategy of dYdX based on pure speculation. Buybacks were introduced around March this year and since then the DYDX token price dropped by over 50%. It is worrying to see many trying to base decisions on ‘it may pump the token price’. There is a serious problem on dYdX with very little revenue for stakers, if we don’t improve this but make it worse removing the little share of revenue left for stakers, then naturally this will lead to large unstaking and dumping of DYDX, since the main utility of DYDX is as staking token to secure the network and earn trading fee revenue. For perps trading DYDX is not needed at all, dYdX v3 started without a token meaning a token wasn’t needed, then it was created purely as a governance token. But currently the main utility of the DYDX token is to secure the network and earn trading fee revenue, if we remove this utility nobody would want to buy or hold DYDX and the price will dump further

Sharing this here as well from the other discussion:

The Treasury SubDAO executes the Buy & Stake program approved by the DAO (stage 1 & 2) — buying DYDX (open market + OTC) and staking it with validators, increasing the delegated stake and strengthening the network security.

Execution results (last 3 months):

| Month | DYDX bought | USDC spent |

|---|---|---|

| Aug | 1,091,967 | $720,375 |

| Sep | 1,026,281 | $668,318 |

| Oct | 230,951* | $82,670 |

*No OTC purchases were executed in October.

The Treasury SubDAO also used the Rev Share address for OTC purchases when Buyback revenues alone could not sustain the intended buying pace.

At present, 25% of dYdX protocol revenue is allocated to DYDX Buybacks, resulting in roughly $386k/month in realised purchases (3-month average).

The Treasury SubDAO currently facilitates around 1 million DYDX purchases per month, funded in USDC through operational inflows, meaning these tokens are NOT directly sold back into the market.

Following ongoing forum discussions, the following redistribution of protocol revenue is being considered:

| Model | Buybacks | Treasury | Megavault | Staking |

|---|---|---|---|---|

| Current | 25% | 10% | 25% | 40% |

| 75% Proposal | 75% | 5% | 5% | 15% |

| 80% Proposal | 80% | 5% | 0% | 15% |

The proposed changes would triple the monthly buyback budget (to reach ~$1.16M USDC/month) but also reduce staking rewards from 40% to 15%.

This reduction represents a significant decline in validator incentives. Staking rewards are a crucial component of the network’s economic security; compressing them may weaken validator retention and motivation to stay online. Such a shift could increase validator churn and exits, thereby undermining the network’s equilibrium and overall security.

We therefore encourage the ecosystem to consider targeted support mechanisms during the transition period in order to preserve validator stability and ensure the network continues to operate securely while the new revenue allocation is phased in.

So currently with 25% revenue share for buybacks it was around $386k/month for buybacks while the Treasury subDAO in your buy & stake program spent around $700k/month for the buybacks? In the scenario of 95% revenue share for stakers and 5% for the treasury, this increased staking yield would lead to how much more spent monthly in your buy & stake program, and would this be a higher amount of buybacks than reducing staking yield to 15% and increasing buybacks from protocol revenue alone to 80%? @staza @RealVovochka I think this calculation and comparison is key, because if with 95% share for stakers this leads to more buybacks via the Treasury buy & stake program than with 80% share for buybacks alone, then definitely the model 3 of 95% for stakers and 5% for treasury should be implemented

the best way its to increase the staking by 10% and the buyback by 25%.

50% buyback

50% staking rewards

0% treasury

0% mégavault

We are increasing the revenue for stakers on one hand, and reducing the amount of DYDX available on the market, which then ends up being staked with our validators. It’s a win-win for everyone.

So to summarise, we have 2 buybacks happening in parallel at this moment:

-

With the 25% revenue share for buybacks, this equates to about $386k per month spent on buying back DYDX tokens. (This is based on approximate annual revenue of ~$20M, though exact figures fluctuate with trading volume.)

-

Separately, the Treasury subDAO’s “buy & stake” program spent around $700k per month on buybacks. This program uses Treasury funds to buy DYDX tokens and then stake them. It’s effectively an additional buyback mechanism, but the bought tokens are staked rather than distributed. This $700k is higher than the direct protocol buybacks, likely because the Treasury has accumulated funds over time or uses its allocation efficiently.

Additional thoughts on “95% to stakers, 5% to Treasury” model:

The Treasury’s 5% allocation, though smaller, could be amplified so that with higher yields, the Treasury’s staked holdings earn more rewards, which can be reinvested into buying more DYDX (compounding effect ish).

@kpk I think the funds for the buybacks are not ‘funds in the treasury’ but rather a % of the USDC staking rewards received as part of your delegation program? Also @staza staking the buybacks is good because they increase the security and resilience of dYdX and also they are similar to ‘burns’ because they are locked in staking and not sold in the markets

I agree in model 3 the exact % for stakers and the treasury needs to be studied in detail to see which brings the best results overall, with 5% and 95%, 10% and 90% and other combinations

Why did you put the proposal onchain in a rush and so unprofessionally without addressing all the valid arguments and concerns? @kpk @staza @RealVovochka and many others presented clear arguments against this proposal and why it puts at risk the integrity and security of dYdX affecting very negatively stakers and validators. Moreover, staza presented an analysis where it shows with numbers that a higher revenue share for stakers actually brings better results long term. Moreover, Kpk also explained how they already have their own buy & stake program which is like a buyback program and more effective than using such high revenue share for more buybacks. Other topics like DYDX for Surge being allowed only to be staked and many other relevant arguments were just ignored by Nethermind and they rushed to put the proposal onchain so we voted NO and very dissapointed about this behaviour with a proposal that has major implications for dYdX and putting at risk its core integrity and security

Also, I would study Uniswap’s recent proposal which involves activating fee switch to divert a portion of protocol swap fees toward benefiting UNI token holders.

However, this is not through direct revenue sharing. Instead, the fees are routed to a smart contract called the “token jar,” where UNI holders can voluntarily burn their tokens via a “fire pit” mechanism to withdraw an equivalent amount of crypto from the jar, effectively reducing the token supply and aiming to increase the value of remaining tokens.

The proposal also includes a one-time retrospective burn of nearly 100 million UNI tokens (valued at around $800 million), representing fees that would have accrued if the switch had been active since Uniswap’s launch.

This setup provides indirect value accrual via deflationary pressure rather than direct payouts, emphasizing burns over direct distribution.

This about uniswap can’t really be compared for several reasons. First, uniswap doesn’t need to worry about security as dYdX, or incentivizing stakers or validators, however dYdX needs to manage its own security and for that it is critical to have a yield for stakers and validators to maintain a sufficient level of security. Also, in the case of uniswap the goal is to focus on UNI token holders, but in the case of dYdX the yield is in USDC, stakers may prefer a larger USDC yield and don’t care so much about DYDX and similarly for validators. And if burning is such a big goal for dYdX why not burning like uniswap tokens from the treasury rather than taking away yield from stakers to burn this?

Fair enough. Thanks a lot.

Dear dYdX Community,

The proposal to adjust protocol revenue sharing is now live. This proposal builds upon the recent text proposal to allocate 80% of protocol revenue for the buyback program, which received strong community support.

The text proposal was non-binding and a good indication of community support to increase the percentage of protocol revenue directed to the Buyback Program.

The main difference between our proposal and the previous text proposal to increase buybacks to 80%:

- 75% to the Buy & Stake Program

- 5% to MegaVault

Rationale for a 5% allocation of revenue to Megavault:

- Reduced allocation would help reduce MegaVault’s scope to focus on providing liquidity on newly listed markets, potentially improving its performance over time.

- Market listings are still dependent on depositing $10K into Megavault.

As such, we have recommended the following revenue share allocation through the on-chain proposal:

| Allocation | Current Revenue Share | Proposed Revenue Share |

|---|---|---|

| Buy & Stake Program | 25% | 75% |

| MegaVault | 25% | 5% |

| Treasury SubDAO | 10% | 5% |

| Stakers & Validators | 40% | 15% |

We encourage the community to vote in accordance with their vote on the text proposal to carry forward the momentum from Proposal #304 and align incentives with long-term protocol growth.

You missed the point that it was 3 months trial and your proposal is limitless

Exactly, the previous text proposal was just for 3 months trial and keeping the same revenue share for stakers from other sources like the treasury. This proposal from Nethermind is totally different, it is not a 3 months trial but indefinite and they didn’t address at all the issue of cutting huge revenues from stakers and validators, therefore it seems that either Nethermind overlooked and didn’t understand the previous text proposal or they intentionally are trying to confuse the dYdX community into voting in favour of their proposal

The repurchased tokens do not have a burn mechanism, and staking rewards are almost nonexistent.

The repurchased tokens can be burned.

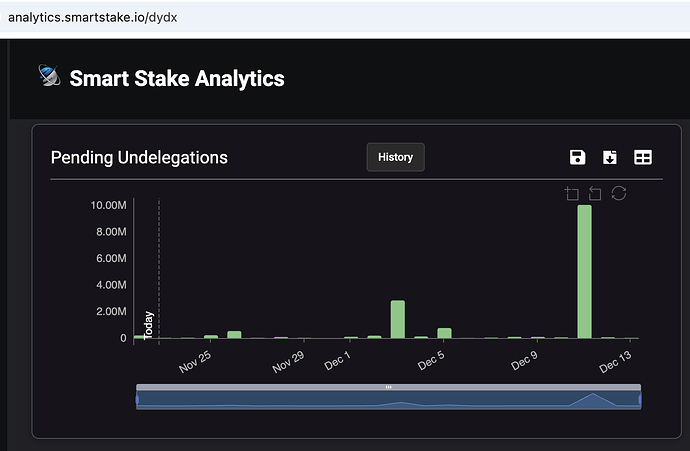

@nethermind We have a major unstaking event happened right after this proposal passed - 10M tokens will be unstaked on 11.12.

The effect of no term changes which you purposed must be analyzed in a greater details.

@nethermind as I mentioned, small buybacks doesn’t have any positive effect on the price, since your proposal passed the dYdX price has just been going more and more down, the only think you achieved is hurting dYdX stakers with less than half the revenue share, who will now unstake and drive the price even lower. I will start preparing with other community members a proposal to direct 95% revenue share to stakers as it should be, the treasury subdao is already doing buybacks

Based on the insights shared, the recommendations clearly point toward prioritizing capital-efficient mechanisms like enhanced buybacks while scaling back underperforming incentives such as the MegaVault. If you want to share this analysis with your team or community for quick feedback, you can simply transfer the file through any reliable mobile-to-mobile , or from mobile to PC sharing platform for faster collaboration.