I purpose to discuss this DRC as a follow-up of recent posts related to “buybacks VS staking rewards” which happened here and here resulted in a quite fast approval of 75% buybacks but w/o the original idea of 3 months of trial this new fee split before making final decisions.

Summary

This DRC proposes sending 90% of all net trading fees on the dYdX Chain directly to DYDX stakers, with the remaining 5% going to the Community Treasury and 5% to Megavault.

This restores DYDX to its intended role as a staking token. Users stake DYDX and receive real revenue from trading activity in the form of USDC, not more DYDX or secondary incentives.

This model fits crypto industry shift toward yield-based and revenue-to-holders tokenomics, now common across leading perps DEXes and high-performing real-yield platforms.

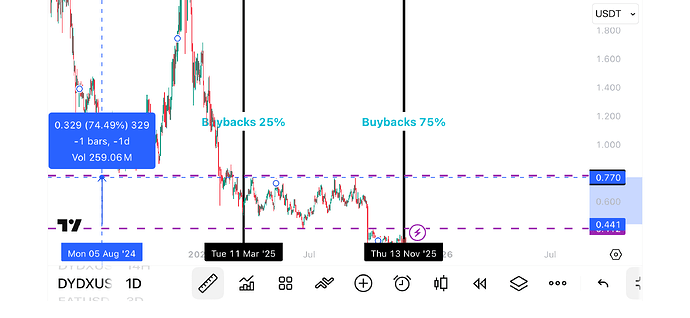

Recent experience with the 75% buybacks / 15% staking structure showed limited price impact and rising unstaked supply. In contrast, competitor protocols that distribute revenue directly to stakers have stronger performance, clearer valuations and higher user participation. I need to mention that, 25% buybacks which were already introduced in early 2025, didn’t deliver any positive results and since then the price just went more down and unstaked supply raised, increasing circulating supply and pressure on price.

This proposal aligns DYDX with the new market standard and reinforces the original design of the DYDX Chain - stake DYDX and earn the protocol’s real trading revenue.

Background

It took some time for me to perform deeper analysis on effect of buybacks and I want to start with the telegram post of Stacy Muur - frequently quoted DeFi and blockchain analyst:

*Source: telegram channel of Stacy Muur https://x.com/stacy_muur

Buybacks are not a silver bullet, and they affect price of other token differently:

-

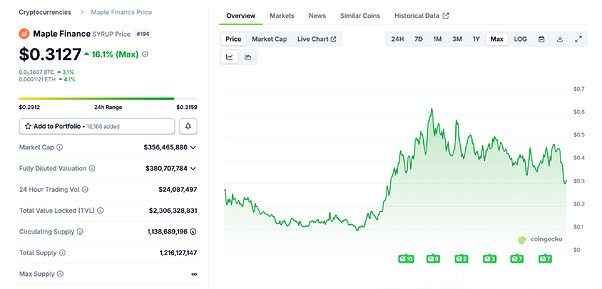

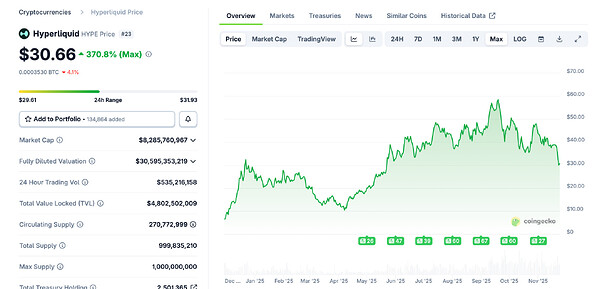

only SYRUP and HYPE price action is positive

-

for the other projects like AAVE, JUP and ORCA it didn’t bring an impact.

I also need to highlight that in late November 2025 (23.11) both of these protocols - HYPE and SYRUP suffered significantly despite the mentioned success of their buybacks programmes: HYPE dropped 49% from ATH and SYRUP dropped 60% from it’s LH.

*Source https://www.coingecko.com/

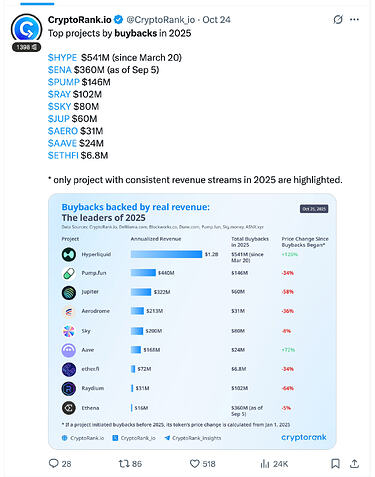

Another example from CryptoRank, which illustrates the similar opinion towards buybacks:

*source https://x.com/CryptoRank_io/status/1981833757784256641

It is also important to highlight that buybacks are similar to a reduction of inflation in the hope of increasing the token price, but there are numerous examples where this did not work. For example, Celestia reduced inflation around 33% last July, and since then the token price just went from around $3 to less than $1. For another example, Cosmos Hub halved the maximum inflation around 2023 and since then the token price went from around $10 to around $2. In practically all cases where inflation was reduced or buybacks increased in the hope of raising the token price almost always the opposite happened proving that this logic is flawed. When inflation is reduced or buybacks increased at the cost of lower yield for stakers, then staking for many no longer meets their risk profile requirement of locking their tokens for an extended period of time and hence they unstake and move to better yield and risk-reward opportunities

I need to also highlight changes in market trends: recently, the broad crypto market started to shift toward real-yield frameworks, where token holders receive revenue with the leading models like Uniswap and Aerodrome.

Compared to these protocols, buybacks alone rarely create sustained price growth unless emissions drop to zero.

Back to DYDX.

The current fee split is:

- 75% buybacks

- 15% stakers

- 5% treasury

- 5% MegaVault

This replaced the earlier model which was implemented in March 2025:

- 25% buybacks,

- 40% staking,

- 10% treasury

- 25% MegaVault

The original 25% buybacks allocation didn’t help to increase token price. The move to 75% buybacks was intended to increase mechanical support of price, but we can see that even more significant buybacks do not create meaningful appreciation because they were offset by trader sell pressure and because APY from 15% of fees was too small to attract new stakers.

* illustration of buybacks effect on token price

An additional factor is that the approach towards DYDX tokens distribution as a reward was not changed and traders prefer to sell tokens after they receive them.

The result is the opposite of what community hoped for: with 75% buybacks of the token - protocol burns a significant amount of revenue but the token’s price was affected negatively and unstaked DYDX supply increased.

*source https://app.range.org/dydx/general

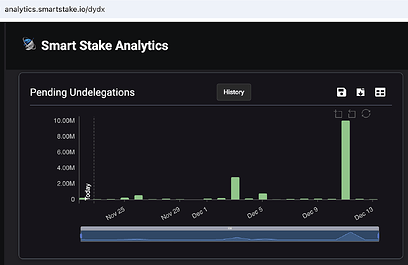

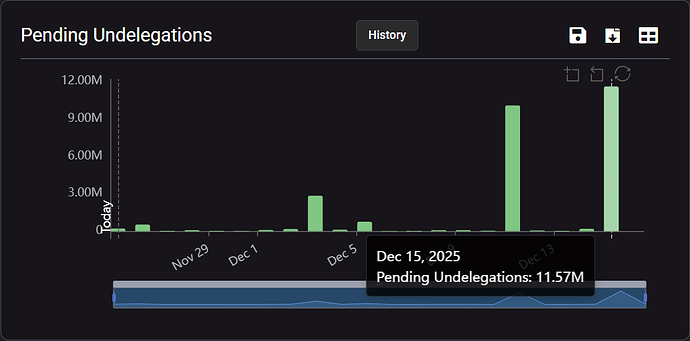

Also, you can see that right after 75% buyback proposal passed, a major unstaking event happened and 10M tokens will be unstaked on 11.12. This means the stakers are not that happy with the decision and Nethermind’s assumption that “stakers don’t care about yield” was not 100% correct.

*source https://analytics.smartstake.io/dydx

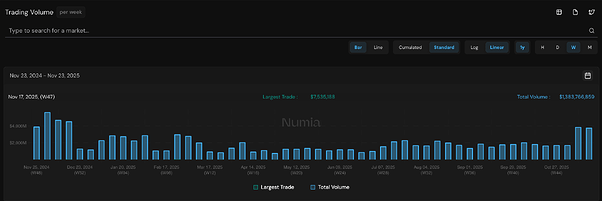

In general, if we analyze the DYDX protocol’s YoY trading volume - it is quite stable (in a good sense):

*source https://www.datalenses.zone/chain/dydx/trading_volume

The similar state is for YoY revenue, which is lower compared to last year, yes but still stable:

*source https://www.datalenses.zone/chain/dydx/business

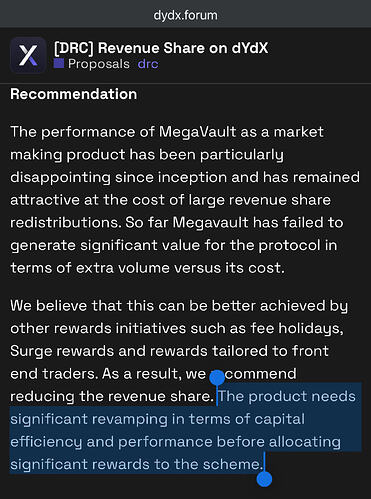

So my question is - why do we need to burn it (revenue) on buybacks which don’t really affect the token’s price? Is this the best way?

DYDX still suffers from circular supply coming from trader rewards and scheduled unlocks (ending in early summer of 2026). These flows reduce the positive impact of any buybacks. At the same time, DYDX Chain depends on having enough tokens staked because its security model is built on it.

The original role of DYDX token was simple: a governance and staking asset that captures protocol revenue. This proposal returns to that foundation. The goal is to bring back the core utility of the token by giving stakers real yield from the protocol. This works towards traders attraction, creates a clear incentive for users to stake and helps the price grow in a natural way.

DRC

Goals

Move DYDX back to its intended identity: not only governance, but a staking token that earns real income from trading activity.

Redirect 90% of net fees to stakers (which they will receive in USDC according to existing architecture) and 5% to the Community Treasury. Another 5% will used to keep MegaVault up and running.

The goal is to strengthen staking participation, reduce unstaked supply, improve token valuation, and align DYDX with the revenue-driven models.

Proposal Details

Change parameters of the DYDX protocol’s fee distribution ratios.

Current Values:

- 75% buybacks

- 15% stakers

- 5% Community Treasury

- 5% MegaVault

Proposed Values:

- 0% buybacks

- 90% stakers

- 5% to Community Treasury

- 5% to MegaVault

Additional conditions:

-

To avoid circular supply increase:

-

pause Surge and other DYDX-denominated programs

-

change the nature of rewarding program to other ways of incentification like “the more you trade - the less your fees are, because you keep staking rewarded tokens”

-

-

To promote value of the protocol via X and professional DeFi experts:

-

start an on-going marketing campaign on DYDX token’s real yield earning

-

start an on-going marketing campaign on “stake your trading rewards“ (as a follow-up of 1st additional condition)

-

-

To support validators:

- provide small grant of 1000 USDC; it should be maintained regardless of the share of revenue for stakers and validators to ensure most validators have good and reliable infra and don’t change to cheap infra due to high costs

Rationale

The current system splits fees across four destinations, which weakens token value and confuses incentives.

Most importantly, it breaks the original value flow: DYDX stakers are supposed to earn real trading revenue, not small slices diluted by other programs.

APY at 15% of fees is too low to attract new participants, while 75% buybacks fail to overcome continuous sell pressure.

The market now favors direct revenue to holders, not indirect mechanical buybacks.

This model provides:

- Clear APY

- Pure real yield in USDC (original architecture and value of DYDX Chain)

- A simple message to the market “buy token and get real yield”

- Stronger staking participation

- Reduced circulating supply

- A healthier link between volume and demand for DYDX

With monthly fees around $1.6M to $3.3M, stakers yield becomes meaningful, visible, and market-driven.

I really need everyone to participate in this discussion! Please, put all your ideas bellow ![]()