kpk is pleased to present the dYdX Treasury SubDAO’s July Community Update, highlighting key developments and initiatives from the past month, a brief market analysis, DYDX token metrics and the Staking Program Periodic Review #3. This is accompanied by kpk’s July Treasury Report, including detailed treasury performance and strategy review.

Market Update

In July, the White House issued an executive order allowing US 401(k) retirement plans to invest in cryptocurrencies, marking a major regulatory milestone and potentially unlocking trillions in retirement capital for the asset class.

Institutional interest in crypto treasuries continued to grow. Fundamental Global filed to raise up to $5B to purchase ETH, while Chainlink launched Chainlink Reserve, an onchain vehicle to manage LINK for staking, grants and development. Bitcoin asset manager Parataxis announced plans to go public via SPAC, targeting $640M to acquire additional BTC.

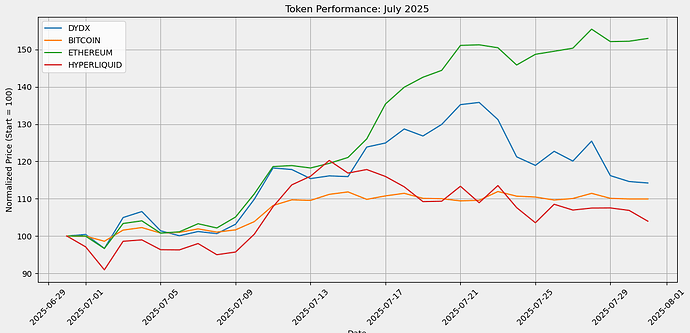

DYDX traded broadly in line with the market, ending the month up 13.7%, with an average price of ~$0.60 during the month. Onchain activity remained consistent, but trading volume experienced a notable decrease. DYDX price outpaced BTC and HYPE, reflecting relatively stronger market momentum during the period.

Trading volumes on the DYDX platform reflected robust market participation, led by ETH-USD and BTC-USD pairs, which accounted for ~40% and ~30% of total 30-day volume, respectively. ETH alone saw $3.42B in notional volume across nearly half a million trades, followed by BTC at $2.71B and XRP at $628M.

Overall, the platform sustained high activity levels across majors and mid-cap assets.

DYDX Buyback Program – July Update

July marked the third full month of execution for the Buyback Program since its inception on April 23rd. During the month, a portion of the USDC held in the buyback account was transferred to the Treasury SubDAO Binance account and swapped for USDT, enabling more efficient use of capital for subsequent purchases. Following this, the program executed two types of buybacks: open-market DYDX purchases via Binance and an OTC transaction.

CEX purchases resulted in the acquisition of 502,936.75 DYDX at an average price of $0.6062577, with tokens periodically withdrawn to the Treasury SubDAO’s buyback account.

On July 18th, the SubDAO completed its second OTC transaction under the program, acquiring 1,000,000 DYDX from dYdX Operations SubDAO in exchange for 622,885.7143 USDC. The trade was executed directly on the dYdX Chain, ensuring full onchain transparency and minimising slippage and market impact.

All buyback-related activity remains fully transparent and can be monitored through the community-built Buyback Dashboard.

A detailed breakdown of July execution performance and key insights is provided below:

Staking Program - Periodic delegation review

In July, the dYdX Treasury SubDAO completed its third periodic review of the Staking Program and implemented targeted delegation adjustments. Following Strangelove’s exit from the validator set (previously delegated 1,919,218.99 DYDX), the Treasury SubDAO reallocated the DYDX tokens to active validators after the unbonding period concluded in late July.

This review stays in line with recent shifts within the dYdX ecosystem and changes to the DYDX token balances managed by the Treasury SubDAO.

Ops Subdao undelegation rebalancing

The Treasury SubDAO has successfully undelegated 1M DYDX from the Operations SubDAO vault and immediately redelegated an equivalent amount from the Staking Vault to offset the unstake. The released DYDX will form a liquid position to cover anticipated monthly operational needs while supporting initiatives to broaden DYDX accessibility, particularly for institutional adoption and alternative distribution networks.

Delegation adjustments

The following adjustments table reflects the delegations rebalancing across selected validators:

| Validator | Delegation |

|---|---|

| InfStones | -1,919,218.99 |

| Kahuna | -1,919,218.99 |

| strangelove | -1,919,218.99 |

| Nocturnal Labs | -1,919,218.99 |

| Provalidator | -1,919,218.99 |

| ECO Stake |

REStake.app |

| polkachu.com | -1,437,311.44 |

| AutoStake |

-886,883.84 |

| Crosnest | -491,464.34 |

| Enigma | -491,463.78 |

| Lavender.Five Nodes |

-491,463.78 |

| Kingnodes |

-491,463.78 |

| CryptoCrew X Defi Dojo | -439,593.56 |

| Chorus One | 204,145.88 |

| Silk Nodes | 399,060.22 |

| Stakecito | 399,060.22 |

| RHINO |

399,060.22 |

| Nodes.Guru | 399,060.22 |

| TTT VN | 399,060.22 |

| Nansen | 424,995.61 |

| Cosmostation | 424,995.61 |

| Imperator.co | 424,995.61 |

| Ledger by Meria | 450,931.00 |

| Smart Stake |

450,931.00 |

| PRO Delegators | 450,931.00 |

| Allnodes | 450,931.00 |

| Meria | 450,931.00 |

| Informal Systems | 494,240.95 |

| Luganodes | 603,614.27 |

| DELIGHT | 603,614.27 |

| Interstellar Lounge |

603,614.27 |

| Blockdaemon | 603,614.27 |

| Nodeplus | 603,614.27 |

| OWALLET | 603,614.27 |

| Cosmic Validator | 608,035.47 |

| coinhall.org |

629,549.66 |

| DragonStake |

629,549.66 |

| Citadel.one | 1,056,149.20 |

| OKX Earn | 2,522,833.26 |

| CLC | 2,522,833.26 |

| Cosmic Nexus | 2,522,833.26 |

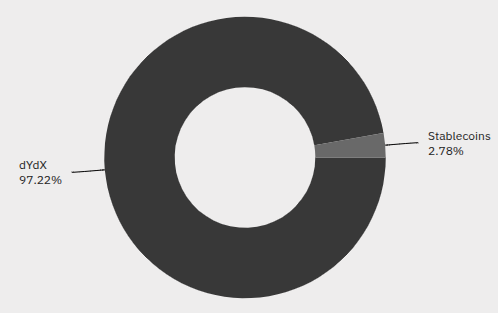

As of July 31, the Treasury SubDAO reached a total value of $49.12M in assets comprising:

-

84.8M DYDX tokens (97.22%) and 1.36M USDC tokens (2.78%).

-

Staking Results: 167.5k USDC generated by the Staking Program.

-

Marked-to-market (“MTM”): Treasury SubDAO assets benefited from an increase in market value of $3.65M in MTM due to an increase in the DYDX token price of 8.4% at June’s end compared to July’s end.

-

Megavault Results: Since the deployment of $300k USDC to Megavault on February 13th, Megavault’s performance has been generating $19.2k, totalling a 13.24% return on investment annualised.

Next Steps for August

-

Buyback Program: Continue DYDX buybacks via both CEX and OTC channels

-

Developing solutions to broaden DYDX access, focusing on institutional adoption and integration into alternative distribution networks.

-

Providing onchain DYDX spot liquidity