kpk is pleased to present the dYdX Treasury SubDAO’s October Community Update, which outlines recent developments, market conditions, DYDX metrics, and programme execution. This update is accompanied by kpk’s October Treasury Report, which provides a detailed review of treasury performance and strategy.

Market Update

October was a reset month for crypto markets. Risk premia widened across majors, funding conditions softened, and market participants rotated more aggressively into stablecoin positions.

Market Performance

BTC traded lower throughout the month, with spot prices unable to maintain support above $105,000. It closed October at approximately $97,800, down 13.5% month on month. The repricing reflected slower spot ETF flow momentum, reduced marginal buying, and a weaker macro backdrop.

ETH underperformed BTC for a second month, closing October at approximately $3,130, down 23.8% month on month. The liquidation episode on 10–11 October triggered forced unwinds of high-leverage ETH perpetual positions. Liquidations during that 48-hour period accelerated the drawdown, with cascading sell pressure pushing ETH perpetual funding lower and driving double-digit intraday moves across several L1 and L2 tokens, as visible in Hyperliquid onchain perpetual data.

Across the broader market, mid-caps and long-tail assets lagged as traders de-risked into more liquid majors and stablecoins. Exchange-related tokens (OKB, CRO, MNT, KCS) also retraced after several months of prior outperformance.

Institutional Flows

ETF flows weakened materially in October. Bitcoin spot ETFs recorded net outflows of approximately $940M, while ETH spot ETFs saw modest net inflows of $120M (BitMEX Research ETF Tracker). Market makers cited the 10–11 October liquidation window as the point where RFQ volumes and appetite for directional exposure contracted.

Market Structure & Dominance

Bitcoin dominance remained broadly unchanged month on month, holding in the mid-50% range. This indicated that the retracement was systemic rather than a rotation between majors.

Total digital asset market capitalisation closed October at approximately $3.36T, a 9.7% month-on-month contraction, reflecting the repricing across majors and the broader de-risking.

Funding & Derivatives

Funding rates moved lower following the 10–11 October deleveraging event.

Off-chain funding (Binance)

• BTC: ranged 1% to 7%

• ETH: ranged 2% to 9%

On-chain funding (Hyperliquid)

• BTC: ranged –2% to +18%

• ETH: ranged –5% to +22%

Open interest also compressed after the liquidations:

• BTC perpetual OI declined from approximately 127k BTC to 115k BTC by month-end

• ETH perpetual OI declined from approximately 2.68M ETH to 2.41M ETH by month-end

DYDX Token Update

DYDX underperformed majors through October, with the token declining sharply after the 10–11 October deleveraging event and stabilising at materially lower levels for the remainder of the month. Relative performance remained weak compared with BTC, ETH, and HYPE, all of which retraced but recovered more of their early-month losses.

Trading activity on the DYDX perpetual markets remained concentrated in the ETH-USD and BTC-USD pairs. ETH-USD recorded approximately $3.18B in notional volume across 556k trades over the past 30 days, compared with $3.76B in the prior month. BTC-USD increased to approximately $3.16B over 618k trades, up from $1.92B previously, indicating a rotation of leverage and liquidity towards BTC. SOL-USD remained the third largest market, with approximately $660M in notional volume across 219k trades, compared with $586.7M in the prior month

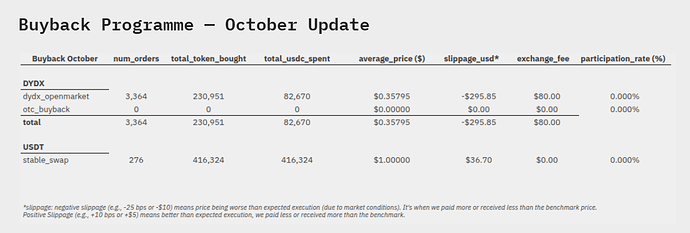

Buyback Programme — October Update

October saw only open-market purchases, with no OTC transactions executed. Open-market activity acquired 230,951 DYDX at an average price of $0.35795 across 3,364 orders, for total USDC outlay of $82,670. Tokens were periodically transferred to the Treasury SubDAO buyback account. All buyback activity remains visible through the community-maintained Buyback Dashboard.

Staking Programme

A small set of delegation adjustments was executed in October to allocate DYDX staked through the Buy and Stake programme. Additional refinements were made to align validator allocations with expected future OTC facilitation requirements. The Q3 staking programme review is being finalised and will include updated validator scoring, parameter assessment, and the next delegation cycle.

Asset Allocation

As of 30 October, the Treasury SubDAO reached a total value of $26.59M in assets comprising:

- Asset Allocation: 85.43 M DYDX tokens (94.93%) and 1.34M USDC tokens (5.07%).

- Yield Generation:

- Staking Results: 155.45k USDC generated by the Staking Programme.

- Megavault Results: -17.08k USDC; since the deployment of $300k USDC to Megavault on February 13th, Megavault has generated $3.56k (~1.67% annualised return).

- The deployment of DYDX/USDC operational funds on Osmosis resulted in a –$76.26k outcome, driven primarily by the –$50.57k change in the market value of DYDX.

- Marked-to-market (“MTM”): Treasury SubDAO assets suffered from a monthly MTM loss of $24.8M due to a decrease in the DYDX token price.

Token Allocation %

Other Updates

Two Directors of the Treasury SubDAO will be replaced to reflect organisational changes within kpk and to support operational continuity.

Next Steps for November

- Buyback programme: continue DYDX purchases across CEX and OTC channels

- Finalise DYDX ETP seeding

- Facilitate cash settlement for service providers