kpk is pleased to present the dYdX Treasury SubDAO’s September Community Update, outlining key developments, market context, DYDX metrics, and recent strategic initiatives. This is accompanied by kpk’s September Treasury Report, including detailed treasury performance and strategy review.

Market Update

The digital asset market consolidated in September following the record highs of August. While volatility remained elevated, major assets saw a rebalancing of flows and relative positioning.

Market Performance

-

BTC (+4.85% for the month) traded lower after failing to reclaim its $124k ATH, closing September at ~$113k. Market sentiment around BTC weakened amid continued outflows from institutional products.

-

ETH (-5.68% for the month) remained resilient, briefly testing the $4.7k level before closing the month at $4.11k. ETH remained the top institutional focus, with derivatives activity and treasury accumulation providing strong demand support.

Institutional Flows

Public ETF data showed that institutional flows cooled in September, with net inflows of ~$1.4 billion into Bitcoin ETFs, while Ethereum ETFs recorded net outflows of ~$669 million, reversing the prior month’s rotation trend toward ETH.

Market Structure & Dominance

-

Bitcoin dominance declined from 58% to 55%, driven by ETH’s continued strength and increased participation in mid-cap assets.

-

Exchange-related tokens remained in focus, though returns were more muted than in August: OKB (+22%), CRO (+14%), MNT (+8%), KCS (+5%).

-

Other notable movers: LINK (+17%), ARB (+12%), DOGE (+9%), while POL (+3%) and PUMP (+2%) slowed after strong August gains.

Underperformers

Underperformers included BONK (-12%), PENGU (-9%), and SKY (-8%), all of which failed to recover from their losses in August.

Market Capitalisation

The total digital asset market capitalisation closed September at $3.72T, down 3.1% MoM, reflecting BTC’s retracement despite resilience across ETH and select altcoins.

Funding & Derivatives

-

Off-chain funding rates (Binance):

-

BTC: ranged between 4–9%, with open interest fell from 131 K to 127 K BTC.

-

ETH: ranged between 6–11%, with open interest up slightly from 2.64M to 2.68M ETH.

-

-

On-chain funding rates (Hyperliquid):

-

ETH: ranged between -4–26%.

-

BTC: ranged between 3-24%.

-

Open interest remained balanced, with ETH and BTC both near $3.5B in OI by month-end.

-

DYDX Token Update

Trading volumes on the DYDX perp market reflected robust participation, led by ETH-USD and BTC-USD pairs, which accounted for ~52.6% and ~26.9% of total 30-day volume, respectively. ETH recorded $3.76B in notional volume across 611,803 trades, followed by BTC at $1.92B over 413,510 trades and SOL at $586.7M across 165,958 trades.

The platform sustained high activity levels across major and mid-cap assets, with XRP, AVAX, and DOGE each contributing over $90M in volume.

What’s new?

September was a landmark month for dYdX, marked by the launch of its first-ever ETP and the deployment of onchain liquidity on Osmosis, two milestones that expand DYDX’s reach across both traditional and decentralised markets.

DYDX’s Very First ETP

21Shares launched its first DYDX exchange-traded product (ETP), establishing a new bridge between traditional markets and DeFi. The initiative was led by the dYdX Treasury SubDAO, which coordinated with 21Shares and a selected market maker to support the listing and ensure smooth secondary market operations. To support initial liquidity, the Treasury SubDAO will seed the product with approximately $7M in DYDX tokens. This launch represents a major step forward in expanding institutional access to the DYDX token and aligns with the SubDAO’s broader mandate to strengthen the ecosystem’s financial position through initiatives including the Staking and Buyback Programmes.

Read the full announcement here

Osmosis DYDX/USDC Pool Deployment

In late September, the Treasury SubDAO launched the DYDX/USDC pool on Osmosis to strengthen DYDX’s onchain liquidity and support trading within the Cosmos ecosystem. The Treasury SubDAO is deploying approximately $400K to seed the pool, split across two active liquidity ranges:

-

$125K between 0.51–0.62 (spot price ±10% around spot) and

-

$147K between 0.45–0.68 (spot ±20% around spot)

The pool operates with a 0.05% fee tier to maintain tight spreads and competitive trading costs. Early data indicates active participation, with $307K in 24-hour trading volume and $276K in active liquidity, signalling healthy market interest and participation. A portion of DYDX remains unallocated and will be added later to rebalance liquidity as prices evolve.

DYDX Buyback Programme – September Update

September marked the fifth month of Buyback Programme execution since its launch on 23 April. During the month, a portion of the USDC held in the buyback account was transferred to the Treasury SubDAO’s Binance account and swapped for USDT, enabling more efficient use of capital for subsequent purchases. Following this, the programme executed two types of buybacks: open-market DYDX purchases and an OTC transaction.

Open-market purchases acquired 126,281 DYDX at an average price of $0.60961, executed across 3,329 orders, with total USDC spent of $76.98k. Tokens were periodically withdrawn to the Treasury SubDAO buyback account.

In addition, an OTC transaction with the dYdX Operations SubDAO acquired 900,000 DYDX at an average price of $0.65704 for a notional amount of $591,336. The trade was executed directly on the dYdX Chain to ensuring full onchain transparency while minimising slippage and market impact.

In total, the September buyback programme acquired 1,026,281 DYDX for $668,318 at an average price of $0.65120. All buyback activity remains fully transparent and can be monitored through the community-built Buyback Dashboard.

A detailed breakdown of September execution performance and key insights is provided below:

Staking Programme — Periodic Delegation Review

No changes were made to the Staking Programme delegation in September.

DYDX ETP Undelegation

In preparation for the ETP launch, the Treasury SubDAO undelegated approximately 11.7M DYDX, representing around 17% of the total delegated DYDX, from each eligible validator. This step was necessary to free up liquidity and meet the funding requirements of the ETP seeding initiative. Following the undelegation period, the funds are now fully available, allowing the SubDAO to proceed with the USD $7M seeding of the DYDX ETP.

Asset Allocation

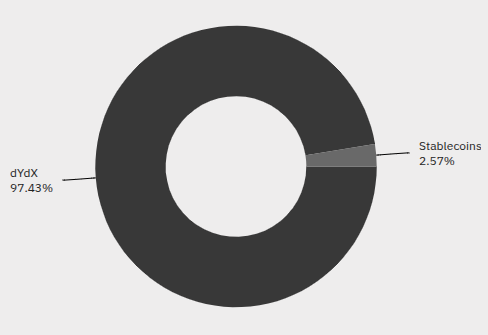

As of 30 September, the Treasury SubDAO reached a total value of $51.26M in assets comprising:

-

Asset Allocation: 84.93M DYDX tokens (97.43%) and 1.42M USDC tokens (2.57%).

-

Yield Generation:

-

Staking Results: 134.03k USDC generated by the Staking Programme.

-

Megavault Results: -3.16k USDC; since the deployment of $300k USDC to Megavault on February 13th, Megavault has generated $20.64k (~10.1% annualised return).

-

-

Marked-to-market (“MTM”): Treasury SubDAO assets suffered from a monthly MTM lost of $998k due to a decrease in the DYDX token price.

Token Allocation %

Next Steps for October

-

Buyback Programme: Continue DYDX buybacks via both CEX and OTC channels

-

Seeding the DYDX ETP

-

Facilitate Service Providers cash settlement