Gauntlet | dYdX MegaVault 10-10 Post-Mortem

Summary

MegaVault realized 10% ($1.28mm pnl) in trading losses and ~$3mm in tvl outflows between Oct 10th - Oct 11th following the largest liquidation event in crypto history

This report covers the following:

- A timeline of events

- Case studies of notable markets that suffered extreme losses

- PnL attribution to different periods within the timeline

Timeline

- initial market move at 20:56 GMT

- Oct 10th 21:19:00 to 21:19:25 GMT MegaVault realizes 500k of losses. 21:19:25 Mainnet goes down.

- Between Oct 10th 21:20 GMT and Oct 11th 4:35 GMT chain has brief moments of resumed activity. MegaVault is quoting during this period and accumulates relatively small inventory and losses due to stale oracle prices

- Oct 11th 4:35 GMT Mainnet is back up and continues to incur losses due to stale oracle prices

- Oct 11th 4:41 GMT the operator is advised that oracle prices are stale. The operator puts all subvaults in “close only” mode shortly after receiving comms. While in “close only” mode, subvaults will only quote to offload risk and will not open new positions.

- Oct 11th 5:41 GMT the operator is advised that oracle prices have updated and can reopen vaults. Vaults are reopened soon after. At this point, MegaVault is carrying large inventory. Quoting parameters are adjusted across all markets to be extremely risk off.

- vaults are reopened at 5:52 GMT

- parameter adjustments issued at 6:10 GMT

- equity rebalance and further parameter adjustments at 6:42 GMT

MegaVault Performance

Below highlights MegaVault metrics during this time period, including

- Hourly sum of subvault pnl (note does not include revenue share)

- Hourly sum of subvault notional positions

- Hourly megavault leverage

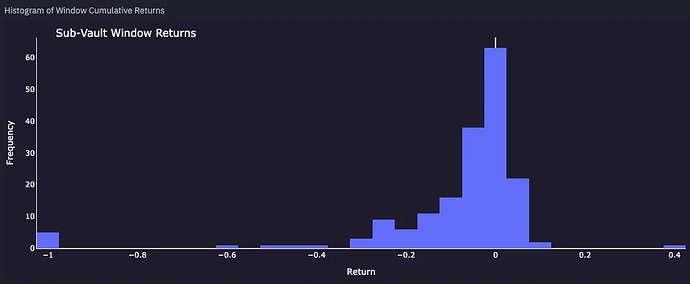

- Histogram of sub-vault cumulative returns over the time period

Below are the 10 markets with largest PnL loss.

| Market | Cumulative PnL | Cumulative Return |

|---|---|---|

| JUP | -$126k | -100% |

| WLD | -$76k | -100% |

| AR | -$73k | -100% |

| ENA | -$50k | -100% |

| IP | -$47k | -100% |

| SUI | -$44k | -62% |

| ADA | -$43k | -26% |

| AVAX | -$42k | -22% |

| WIF | -$36k | -39% |

| TON | -$32k | -50% |

MegaVault absorbed substantial selling pressure during the initial market move leading to a large long position. From there, losses can be attributed to one of three periods:

- Pre-crash → losses due to market movements that were realized prior to the chain halted

- Pre-close → losses that occurred after the chain halted but before the operator closed vaults. These losses can be attributed to stale oracle prices

- Post-reopen → losses that occurred after oracle prices realigned with spot/mark prices and the operator reopened subvaults

| Period | PnL |

|---|---|

| Pre-crash | -$831k |

| Pre-close | -$338k |

| Post-reopen | -$110k |

| Overall | -$1.28mm |

Selected Markets

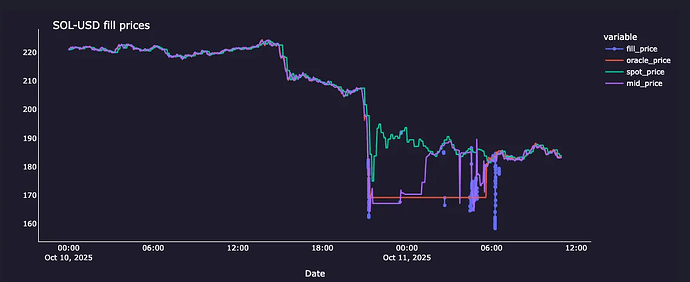

SOL

Of the majors, MegaVault lost the most in SOL ($-28k). The majority of losses came from MegaVault absorbing massive sell pressure on a very thin orderbook once the subvault was reopened. This was overall a loss of 24% on equity.

- accumulated a > $2mm position at 6:09 GMT and 6:12 GMT (shortly after reopening vaults)

- unwinds the majority of the position at 6:15 GMT and 6:18 GMT immediately after the operator incremented parameters

JUP

JUP was the largest pnl loss overall (-$127k) largely occurring due to stale oracle prices. This was overall a 100% loss on subvault equity.

- initial market move at 20:56 GMT caused liquidations resulting in initial 21% drawdown

- accumulated a $35k long position in two trades at Oct 10th 21:14 and 21:17 GMT

- accumulated another $35k long position while mainnet was down at 23:58 GMT. By this point there is 33k of unrealized losses

- between 4:35 and 4:44 MegaVault experiences further liquidations due to stale oracle prices (before vaults were closed)

ADA

ADA was the largest pnl loss incurred from the initial market movement (-$45k) before the chain halted. This was overall a 26% loss on subvault equity.