Gauntlet | dYdX MegaVault Update: 1-Month Insights

(2025-06-01 through 2025-06-30)

Summary

Gauntlet will post monthly updates notifying the dYdX community about:

- Newly listed markets supported by MegaVault

- Markets no longer supported by MegaVault along with insight into the operator’s decision to stop supporting these markets.

- MegaVault performance from a risk, return, and liquidity providing perspective

The aim is to provide transparency into MegaVault performance and operator decision-making. Please also refer to the Gauntlet dashboard for additional stats and information.

Market Status

Over the past month, MegaVault has onboarded 10 new markets (listed below) and now supports 162 markets in total. These markets were added through the Instant Market Listings feature.

- FLR

- LA

- LPT

- MASK

- NEWT

- SOPH

- SYRUP

- WSTETH

MegaVault has also closed 2 markets during this period (listed below). These markets were identified to be honeypot scams and are thus unfit for MegaVault activities.

- DAKU

- TIBBIR

As of Wednesday, June 25th, the market map authority has taken steps to filter out honeypot scams from the universe of listable markets, which will help limit MegaVault’s risk exposure to such markets.

Performance Analysis

| Metric | Current | MoM Change |

|---|---|---|

| 30d APR | 16.3% | -5.3% |

| 30d EWMA % of total maker volume | 2.16% | -0.34% |

| 30d Trading Volume | $134.08mm | +$73.01mm |

| TVL | $14.88mm | -$0.09mm |

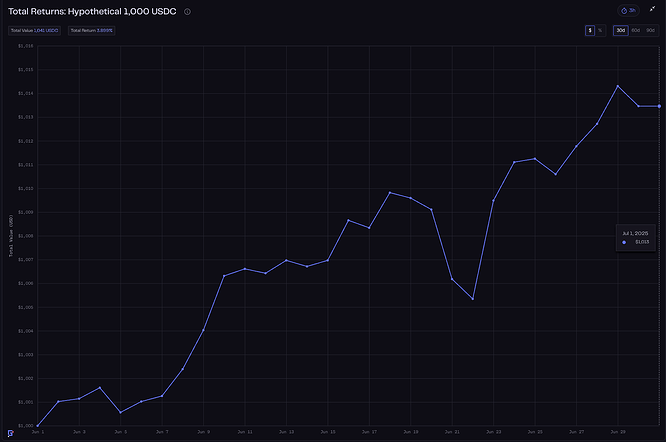

MegaVault performance has remained strong with a current 30 day APR at 16.3%. This represents a month over month decline of 5.3% which is largely due a -0.44% drawdown occurring from June 18th to June 22nd.

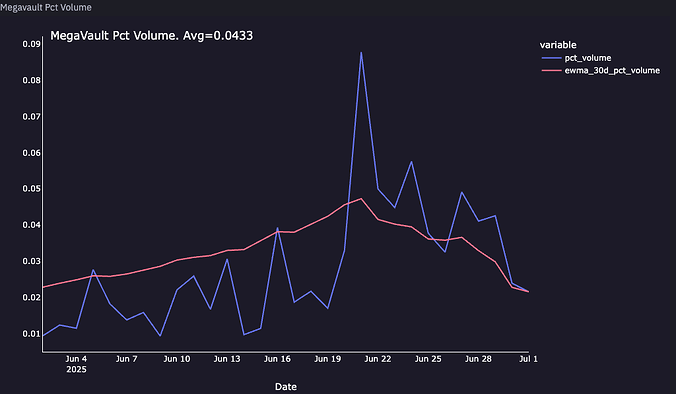

This period coincides with a white house announcement regarding the Israel-Iran conflict and similar drawdowns (and subsequent recoveries) observed in major markets (BTC even hitting a low of $98914). In periods of volatility it is typical to see market makers widening spreads thus leading to the MegaVault absorbing a larger percentage of total market maker volume. We can observe this in the % of total maker volume chart. The exponentially weighted moving average (EWMA) has remained steady at 2.16%, but the daily % of maker volume captured fluctuates wildly, hitting a peak of 8.78% on June 21st. MegaVault recovered the entirety of this drawdown between June 22nd and June 23rd.

Supporting Data

**MegaVault % of total maker volume (for markets which MegaVault is quoting)

Biggest losers over the past 30 days:

| Market | Cumulative PnL ($) | Cumulative Return (%) |

|---|---|---|

| ETH | -12997 | -4.41 |

| DRIFT | -8462 | -8.93 |

| RAY | -7594 | -10.24 |

| TRUMP | -7405 | -7.76 |

| SOPH | -7110 | -9.74 |

Biggest winners over the past 30 days:

| Market | Cumulative PnL ($) | Cumulative Return (%) |

|---|---|---|

| AERO | 14505 | 23.29 |

| MOVE | 9299 | 8.21 |

| HBAR | 8564 | 4.98 |

| BTC | 8538 | 3.00 |

| ORDI | 7019 | 5.52 |

Biggest losers during June 18th to June 22nd drawdown:

| Market | Cumulative PnL ($) | Cumulative Return (%) |

|---|---|---|

| ETH | -10086 | -3.41 |

| RAY | -7468 | -10.11 |

| SUI | -6710 | -2.28 |

| XRP | -5116 | -1.71 |

| SOL | -4244 | -1.86 |