Summary

Gauntlet provides monthly updates notifying the dYdX community about:

- Newly listed markets supported by MegaVault

- Markets no longer supported by MegaVault along with insight into the operator’s decision to stop supporting these markets.

- MegaVault performance from a risk, return, and liquidity providing perspective

The aim is to provide transparency into MegaVault performance and operator decision-making. Please also refer to the Gauntlet dashboard for additional stats and information.

Market Status

Over the course of September, MegaVault has onboarded 10 new markets (listed below) and now supports 180 markets in total. These markets were added through the Instant Market Listings feature.

- 2Z

- ASTER

- AVNT

- HOLO

- IOTA

- LINEA

- PROMPT

- SKY

- WLFI

- XPL

MegaVault closed the following 3 subvaults during this period

- GOONER

- SATS

- TSLAX

GOONER was identified as a honeypot scam. SATS and TSLAX were identified as at risk of oracle attacks due to thin liquidity on oracle price constituent centralized exchanges.

Performance Analysis

| Metric | Current | MoM Change |

|---|---|---|

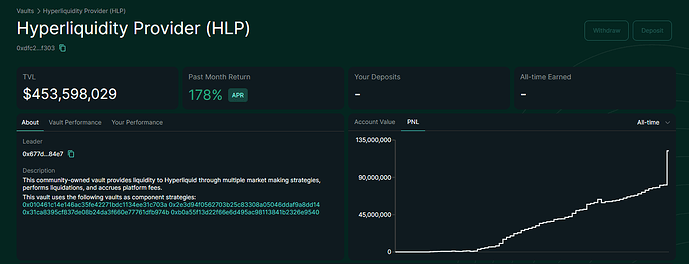

| 30d APR | -12.21% | - 33.26% |

| 30d Trailing Average % of Total Maker Volume | 4.68% | 2.88% |

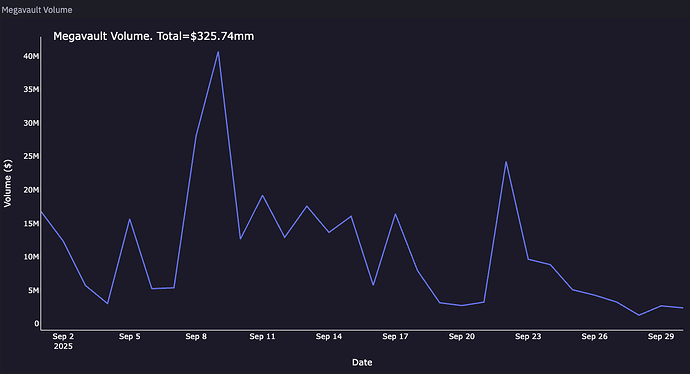

| 30d Trading Volume | $325.74 mm | +$96.13 mm |

| TVL | $14.64 mm | -$17.64 mm |

MegaVault performance suffered in September realizing a 30 day APR of -12.21%. This is due to a drawdown spanning from Aug 27th to Sept 24th of -1.34%. This period saw heightened volatility especially in tail markets. Below are some examples of drawdown attribution at the market level:

- WLD from $0.90 on 09/06 to $2.03 on 09/09, a 126% return in that period

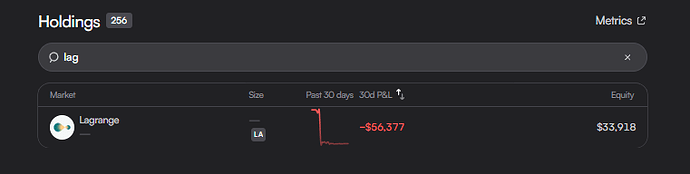

- LA round-tripped from $0.38 to $0.49 and back on 09/18 with similar behavior on 09/24

- ATH from $0.30 to $0.489 on 09/08

- SIGN from $0.08 to $0.12 before falling back to $0.08 on 09/25

In periods of volatility it is typical to see market makers widening spreads thus leading to the MegaVault absorbing a larger percentage of total market maker volume. We can observe this in the % of total maker volume chart. % of total maker volume captured was up 2.88% from last month, and MegaVault trading volume increased month over month from $229.61mm to $325.74 mm.

Supporting Data

MegaVault % of total maker volume (for markets which MegaVault is quoting)

Biggest losers:

| Market | Cumulative PnL ($) | Cumulative Return (%) |

|---|---|---|

| WLD | -72210 | -24.04 |

| LA | -56718 | -34.04 |

| ATH | -42990 | -14.69 |

| SIGN | -41232 | -38.46 |

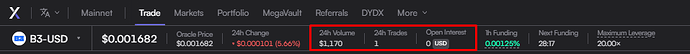

| B3 | -39014 | -18.54 |

Biggest winners:

| Market | Cumulative PnL ($) | Cumulative Return (%) |

|---|---|---|

| WLFI | 9442 | 2.03 |

| ASTER | 8090 | 3.41 |

| TRX | 7988 | 1.82 |

| PENGU | 7385 | 3.87 |

| TIA | 7124 | 2.82 |