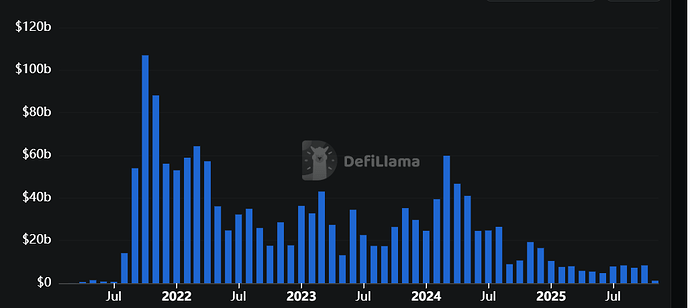

The best solution was 100% of the revenue going to stakers. The problem is that our volume has been divided by about eight. That’s why we had to consider a buyback. If we stay at this level of volume (around 250 million per day), a 50% buyback and 50% for stakers is the most suitable option. If our volume stabilizes around 1 billion per day in the future, the 100% staking model becomes more attractive.

some details around numbers behind modelling

ZKsync: using all network revenue for ZK buyback & burn

Jupiter: 50% of fees to repurchase JUP

AAVE: DAO approves $50M annual buyback

HYPE: 97% of revenue into daily buybacks

GMX: 12.9% of total supply repurchased this year

I can literally visualise how an increase in staking APR will flip the game for a token that’s been setting new lows nonstop for the past 4 years and keep bleeding -20% daily lol

Any of the above-mentioned tokens has shown the best performance since the April lows

During the growth phase, it showed the smallest increase; during the decline phase, the largest drop. Maybe the buyback program isn’t such a bad idea after all?

Clearly this is the best model and the one that should be implemented. Additionally, it seems that dYdX grants pays $2.5k per month ($240k per year) to just 8 validators that actually have similar costs to all the other validators and do similar work, I think this is not fair. It is ok to reward a bit extra these 8 validators, but the other 34 should at least get $1k-1.5k per month from dYdX grants to ensure at least a minimum revenue to sustain operations and infra, what’s the opinion on this?

Not really 4 years drop but since spring 2024. Token has started at the end of previous cycle, and you shouldn’t consider $25 as an ATH. The real one is $4.

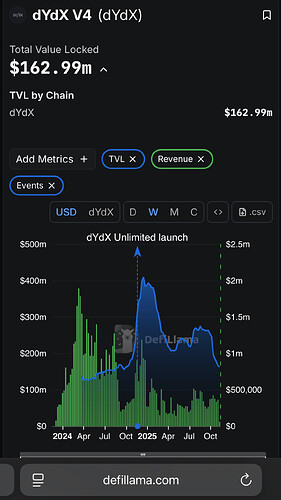

To be more specific on revenue this is the data from defilama

Alright, I’ve said all I could. Without buybacks, I’ll be moving my dydx coins into something more alive. Good luck.

You cried in the other thread that all your dYdX holdings were in ethdYdX, which one is it my guy.

anyways, buybacks at the inception of a bear market is a terrible idea.

You wait until accumulation phase or the dawn of a new bull run.

Buybacks now will just burn any capital put into the ecosystem by capitulation sells that follow the larger crypto market sell off.

Relax, we’re in a bear market, it’s normal for prices to fall, and no buyback will change that.

Sit back, relax, enjoy the show, and look forward to good profits in the bull market.

I’ve never had ethDydx

Buybacks reduce supply. 80% bb = ~8% per yr

This is what we can actually observe at the moment

You need to understand that the users of dYdX v4 are perp traders and they don’t need any DYDX to trade, only USDC. DYDX used to be a governance token, and now a staking token to secure the network and get real yield. Better graph to look at is the perp trading volume, this is what is important, with high trading volume dYdX has long term future, otherwise if no trading volume it is irrelevant any discussion about the token

From my PoV, the problem with the volume is actually linked to having deposits in USDC only, excluding USDT.

That’s a voluntary self-imposed restriction on market liquidity.

I’m glad you made this comment which brings me to why trading fee revenue should go for stakers rather than buybacks. If there is no yield for stakers yes they will unstake, sell their tokens and then the security of PoS of the dYdX chain will be very low putting the platform itself at risk and if it is not secure traders won’t use it. How do we prevent this? Keeping a good yield for stakers so that they stake and secure the network. High real yield in USDC will attract people to buy DYDX and stake it to get this yield and then secure the network. If we focus on increasing the trading volume this will increase the DYDX price much more than buybacks, because with higher trading volume it means more trading fee revenue and hence higher yield for stakers which will lead to more people buying DYDX to get this yield

The Treasury SubDAO executes the Buy & Stake program approved by the DAO (stage 1 & 2) — buying DYDX (open market + OTC) and staking it with validators, increasing the delegated stake and strengthening the network security.

Execution results (last 3 months):

| Month | DYDX bought | USDC spent |

|---|---|---|

| Aug | 1,091,967 | $720,375 |

| Sep | 1,026,281 | $668,318 |

| Oct | 230,951* | $82,670 |

*No OTC purchases were executed in October.

The Treasury SubDAO also used the Rev Share address for OTC purchases when Buyback revenues alone could not sustain the intended buying pace.

At present, 25% of dYdX protocol revenue is allocated to DYDX Buybacks, resulting in roughly $386k/month in realised purchases (3-month average).

The Treasury SubDAO currently facilitates around 1 million DYDX purchases per month, funded in USDC through operational inflows, meaning these tokens are NOT directly sold back into the market.

Following ongoing forum discussions, the following redistribution of protocol revenue is being considered:

| Model | Buybacks | Treasury | Megavault | Staking |

|---|---|---|---|---|

| Current | 25% | 10% | 25% | 40% |

| 75% Proposal | 75% | 5% | 5% | 15% |

| 80% Proposal | 80% | 5% | 0% | 15% |

The proposed changes would triple the monthly buyback budget (to reach ~$1.16M USDC/month) but also reduce staking rewards from 40% to 15%.

This reduction represents a significant decline in validator incentives. Staking rewards are a crucial component of the network’s economic security; compressing them may weaken validator retention and motivation to stay online. Such a shift could increase validator churn and exits, thereby undermining the network’s equilibrium and overall security.

We therefore encourage the ecosystem to consider targeted support mechanisms during the transition period in order to preserve validator stability and ensure the network continues to operate securely while the new revenue allocation is phased in.

When I said we need a complete report on spending in DYDX tokens across the entire ecosystem, I meant it.

In a parallel discussion, Chaos Labs is proposing a distribution of 9 million DYDX tokens. You realize that even if buybacks are 5x, it won’t change much at all. Way more will get dumped into the market. The token should have value. And the only value is staking rewards

True. This “dYdX token as a reward” approach must be stopped.

Yes especially if the DYDX will be instantly sold, DYDX could be given as a reward but only allowed to stake and get trading fee discount for staking the DYDX